What is PRE-IPO?

Pre-IPO, or pre-initial public offering, refers to the stage of a company’s lifecycle before it goes public and offers its shares to the general public through an IPO. During this phase, companies often seek to raise capital from private investors, venture capitalists, and institutional investors. This funding is crucial for growth, product development, and market expansion.

Investing in pre-IPO companies can be an attractive opportunity for investors looking to get in on the ground floor of potentially high-growth businesses. However, it also comes with its own set of risks and rewards.

How to Invest in PRE-IPO Companies?

Investing in pre-IPO companies typically involves a few key steps:

- RESEARCH: Before investing, it’s essential to conduct thorough research on the company, its business model, market potential, and financial health. This includes understanding the industry landscape and the competitive environment.

- Accredited Investor Status: In many jurisdictions, pre-IPO investments are limited to accredited investors—individuals or entities that meet specific income or net worth criteria. This is due to the higher risks associated with these investments.

- . Investment Platforms: Several online platforms specialize in connecting investors with pre-IPO opportunities. These platforms often provide detailed information about the companies seeking investment, including their business plans and financial projections.

- Direct Investment: In some cases, investors may have the opportunity to invest directly in a company through private placements. This usually requires a significant minimum investment and may involve negotiating terms directly with the company.

- Stay Informed: Keeping up with news and developments in the startup ecosystem is crucial. This includes following industry trends, regulatory changes, and market dynamics that could impact the company’s performance.

Risks and Rewards of Pre-IPO Investments

| Risks | Rewards |

| 1. Lack of Liquidity: Pre-IPO investments are typically illiquid, meaning that investors may not be able to sell their shares easily or at all until the company goes public or is acquired. | 1. High Growth Potential: Investing in pre-IPO companies can yield substantial returns if the company grows rapidly and successfully goes public. |

| 2. High Failure Rate: Startups and early-stage companies have a high failure rate. Many pre-IPO companies may not succeed, leading to a total loss of the investment. | 2. Early Access: Investors have the opportunity to invest in companies before they become widely known, potentially leading to significant gains. |

| 3. Valuation Challenges: Determining the fair value of a pre-IPO company can be difficult. Investors may overpay for shares based on optimistic projections or hype. | 3. Valuation Challenges: Determining the fair value of a pre-IPO company can be difficult. Investors may overpay for shares based on optimistic projections or hype. |

| 4. Regulatory Risks: Changes in regulations or compliance issues can impact a company’s ability to go public or operate effectively. | 4. Influence: Early investors may have a say in the company’s direction and strategy, especially if they invest through private placements. |

| 5. Market Volatility: The market conditions at the time of the IPO can significantly affect the stock price. A downturn in the market can lead to a lower-than-expected valuation. | 5. Tax Benefits: In some jurisdictions, there may be tax incentives for investing in startups or small businesses, which can enhance overall returns. |

How Pre-IPO Works?

The pre-IPO process typically involves several stages:

1. Seed Funding: This is the initial capital raised to start the business, often from founders, friends, and family.

2. Series Funding: As the company grows, it may go through multiple rounds of funding (Series A, B, C, etc.) to raise additional capital. Each round typically involves selling equity to investors at increasing valuations.

3. Preparation for IPO: Once the company reaches a certain size and maturity, it begins preparing for an IPO. This includes hiring investment banks, conducting audits, and filing necessary paperwork with regulatory bodies.

4. **Roadshow**: The company and its underwriters conduct a roadshow to market the upcoming IPO to potential investors, showcasing the company’s strengths and growth potential.

5. **IPO Launch**: Finally, the company goes public, and its shares are listed on a stock exchange, allowing the general public to buy and sell shares.

Start-up Highlight: Roobeez

Overview of Roobeez

Roobeez is an innovative farm marketplace that is rapidly gaining attention as it approaches its pre-IPO phase. The company is revolutionizing the agricultural sector by offering a peer-to-peer transport and delivery service specifically designed for farms. This unique concept not only addresses the logistical challenges faced by farmers but also taps into the growing demand for fresh, locally sourced produce.

Why Roobeez is a Great Company to Watch?

1. Innovative Concept**: Roobeez’s platform connects farmers directly with consumers, allowing for efficient delivery of fresh produce. This model reduces the need for intermediaries, ensuring that farmers receive a fair price for their products.

2. Market Demand**: With the increasing consumer preference for fresh and organic produce, Roobeez is well-positioned to capitalize on this trend. The demand for farm-to-table services is on the rise, making Roobeez a timely investment opportunity.

3. Scalability**: The peer-to-peer delivery model is highly scalable, allowing Roobeez to expand its services to various regions and potentially internationally. This scalability enhances the company’s growth prospects.

4. Sustainability Focus**: Roobeez emphasizes sustainability by promoting local farming and reducing carbon footprints associated with long-distance food transportation. This aligns with the growing consumer awareness and preference for environmentally friendly practices.

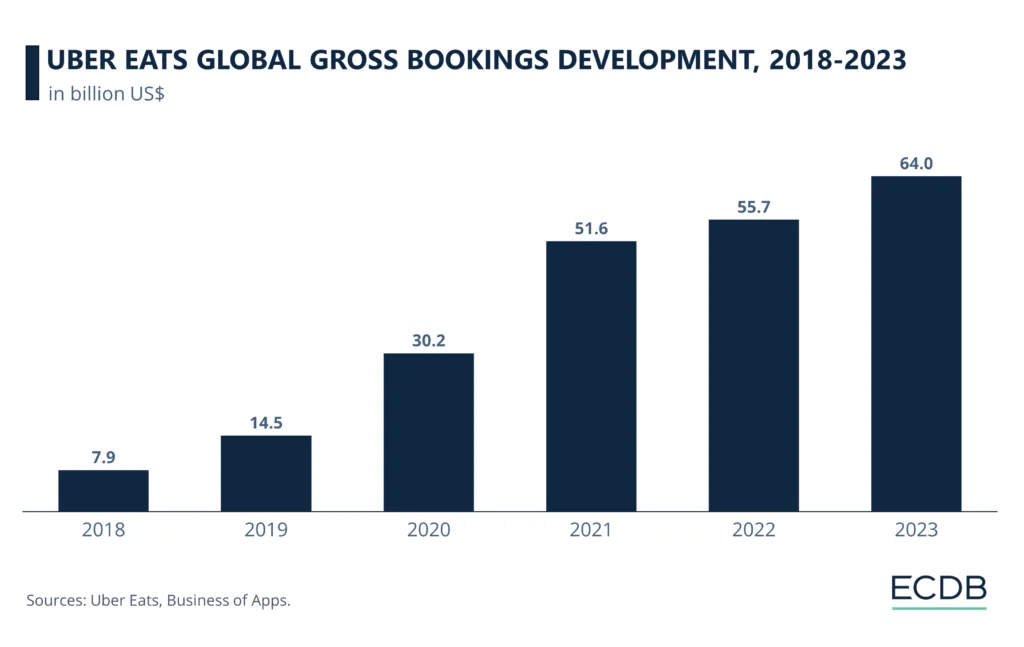

Roobeez Farmtrack Program vs. UBER

Roobeez’s Farmtrack program can be compared to UBER in terms of its operational model. Just as UBER connects drivers with passengers, Roobeez connects farmers with consumers seeking fresh produce. This similarity highlights the potential for Roobeez to disrupt the traditional agricultural supply chain in the same way UBER transformed the transportation industry.

UBER’s Market Worth

As of 2023, UBER is valued at approximately $70 billion, showcasing the immense market potential for companies that leverage technology to streamline services. Roobeez, with its innovative approach to farm delivery, has the potential to capture a significant share of the agricultural market, which is valued in the trillions globally.

Investment Potential in Roobeez

Investing in Roobeez offers a unique opportunity to be part of a growing sector that combines technology with agriculture. The company’s focus on independent delivery services for farms positions it well to meet the increasing demand for fresh produce while supporting local economies.

The agricultural delivery market is ripe for disruption, and Roobeez’s innovative model could lead to substantial returns for early investors. As consumers continue to prioritize fresh, locally sourced food, Roobeez is poised for significant growth.

Conclusion

Investing in pre-IPO companies like Roobeez can be a rewarding venture for those willing to navigate the associated risks. With its innovative farm marketplace and peer-to-peer delivery service, Roobeez stands out as a company to watch as it approaches its pre-IPO phase.

For those interested in exploring investment opportunities with Roobeez, more information can be found on their official website and through various investment platforms that specialize in pre-IPO offerings. As the company continues to grow and expand its services, it presents a compelling case for investment in today’s economy.

Where to Find More Information

To learn more about Roobeez and its pre-IPO options, visit their official website or check out investment platforms that feature pre-IPO opportunities. Engaging with the company’s updates and news will provide valuable insights into its growth trajectory and investment potential.

By staying informed and conducting thorough research, investors can make educated decisions about participating in the exciting world of pre-IPO investments.